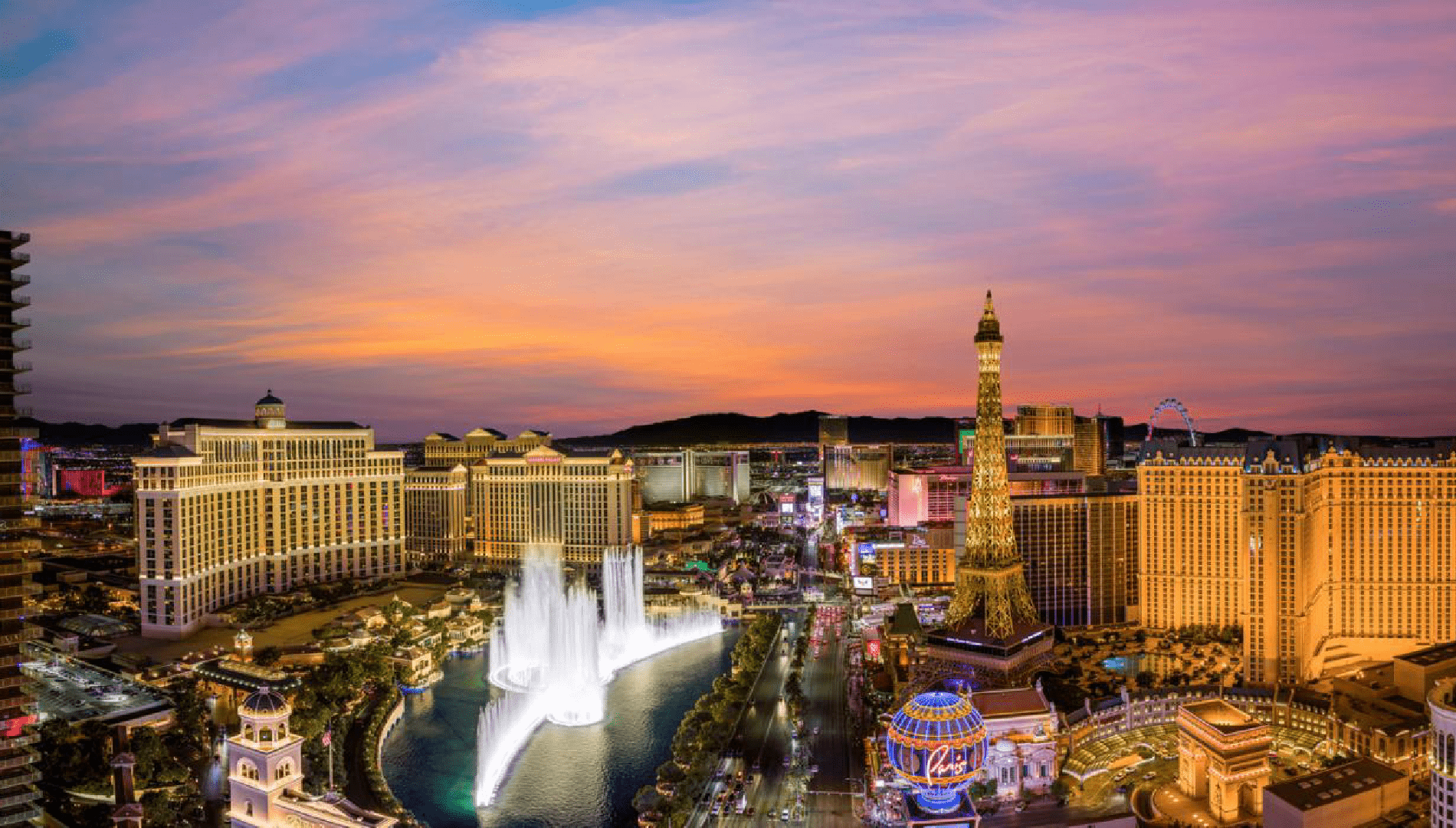

Las Vegas Casino Consumer Still in Strong Shape, Says Analyst

The fact that tourists are still traveling to Las Vegas may help the first-quarter earnings of casino operators.

Concessionaires in Macau and internet gambling companies are also well-positioned to profit from steady consumer spending trends. Macquarie analyst Chad Beynon views Macau operators, internet betting companies, and large Las Vegas Strip casinos as the preferred ways to play, with gaming suppliers and local casino companies trailing behind that group. Beynon cites consumer stability as support for his observations.

According to Benyon, first-quarter revenue per available room (RevPAR) for Caesars Entertainment (NASDAQ: CZR), MGM Resorts International (NYSE: MGM), and Wynn Resorts (NASDAQ: WYNN) is expected to rise by mid- to high-single digits. The Super Bowl last month improved those forecasts.

"Our analysis incorporates data for February, which came in at +63% YoY in Vegas (Super Bowl benefit),” wrote Beynon. “By comparison, this compares to the F1 benefit in November, driving RevPAR growth of +24%. We think MGM/CZR are better positioned to capture this benefit vs 4Q, when disruptions and a skew to higher-end F1 customers affected results.”

On Wynn, he has "outperform" ratings, as do the two biggest Strip companies, MGM and Caesars.

Reasonably optimistic about Macau

In Macau, March is usually a good month compared to December since the Chinese casino enclave's gross gaming revenue (GGR) usually rises by 6%. This month, Beyoncé has experienced 5% growth, which may indicate that concessionaires will expect respectable first-quarter earnings.

With five casino hotels, Las Vegas Sands (NYSE: LVS) is the biggest operator in Macau; Wynn Macau and MGM China each operate two integrated resorts. All three operators increased their market share in 2023, according to recent data.

“Consensus now calls for 1Q24E Macau EBITDA quarter-over-quarter to be as follows: LVS +9%, WYNN +2%, and MGM -4%,” added Beynon. “We expect 2024E GGR of -19% vs 2019 (+29% year-over-year), or ~US$29.5bn, with mass continuing to run above pre-pandemic levels.”

The U.S. firms most exposed to Macau, Sands and Wynn, have price targets set by Benyon that suggest upside of 20% and 27%, respectively.

Reduced Optimism for Local Casino Names

Although the U.S. consumer looks resilient to rising interest rates and continuously high inflation, some slight indications of slowdown in a few regional markets show that this resilience isn't consistent throughout all gambling areas.

“January was difficult, given abnormally disruptive weather in as many as three of four weekends in some regions. All told, January results (the least important month of the year) experienced a -6% GGR. At this time, we stick with our 1Q US Regional estimate of -1% (-1 to -2% SS), while current cons calls for a 4% YoY EBITDA decline,” concluded the analyst.

Five of Beyonon's eight "neutral" ratings for gaming equities in his covering universe are related to local casino operators. Bally's (NYSE: BALY), Boyd Gaming (NYSE: BYD), and Monarch Casino & Resort (NASDAQ: MCRI) are the five companies in question.